child care tax credit 2020

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

If you cant claim the Child and Dependent Care Credit or are looking for more ways to reduce your tax bill consider these tax credits and deductions.

. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Total Child Tax Credit. Calculating the Child and Dependent Care Credit until 2020 For tax years through 2020 the Dependent Care Credit is 20 to 35 of qualified expenses.

Get Your Max Refund Today. 3000 for 1 person. For 2020 this means that any children.

TurboTax Makes It Easy To Get Your Taxes Done Right. In 2020 the credit was worth up to 3000 for one dependent and 6000 for two or more dependents. TurboTax Makes It Easy To Get Your Taxes Done Right.

No Tax Knowledge Needed. Receives 1800 in 6 monthly installments of 300. Between December 2021 and this January the IRS sent families that received child tax credit payments a letter with the total amount of money they got in 2021.

Ad Discover trends and view interactive analysis of child care and early education in the US. The percentage of your qualified. This credit has been greatly changed as part of the.

Complete Edit or Print Tax Forms Instantly. The CTC is worth up to 2000 per qualifying child but you must fall within certain income limits. You must reduce the expenses primarily for the care of the individual by the amount of any dependent care benefits provided by your employer that you exclude from gross.

Your child can be the care provider if they are 19 years old or older. For the 2020 tax year the child tax credit was 2000 per qualifying child. Who qualifies for the.

Moreover the maximum amount a taxpayer could claim was up to 3000. The 2020 Child Tax Credit The Child Tax Credit is available to taxpayers who have children who are under age 17 at the end of the tax year. For your 2020 taxes which.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Up to 3600 per. Get Your Max Refund Today.

Increased to 3600 from 1400 thanks to the American Rescue Plan 3600 for their child under age 6. Below the calculator find important information regarding the 2020 Child and Dependent Care Credit CDCC. Access IRS Tax Forms.

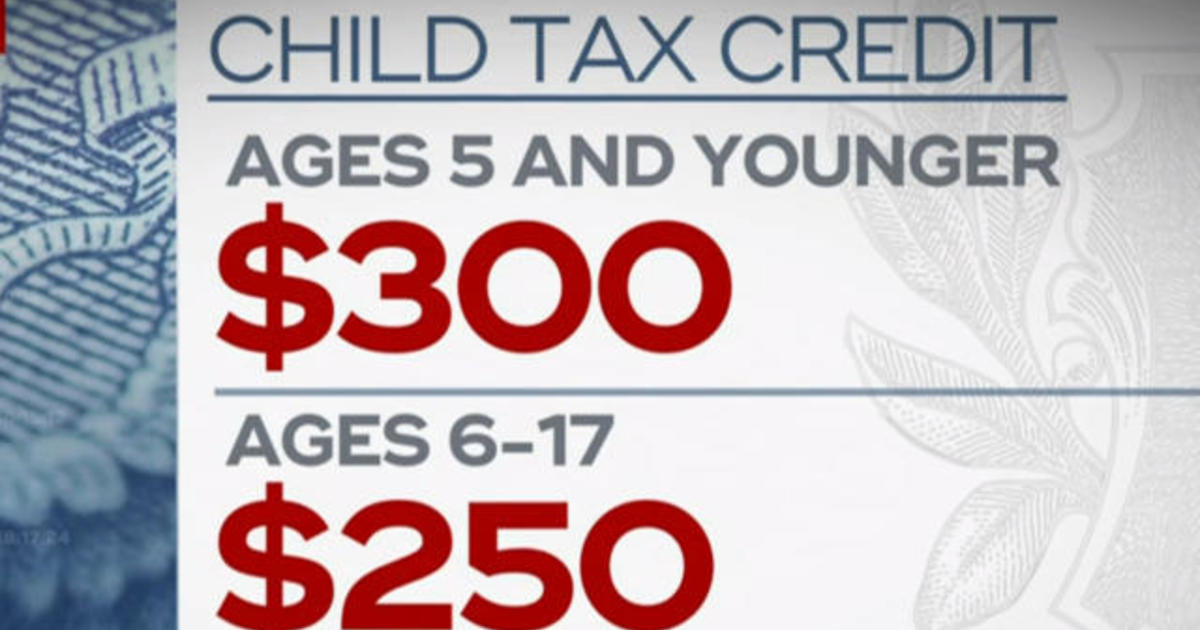

What is the income limit for Child Tax Credit 2020. The advanced child tax credit which was extended from 2020 is worth 3600 for children below the age of six and 3000 for children between the ages of six and 17. If you qualify you may only claim expenses up to.

The percentage depends on your. 6000 for 2 or more people. Up to 3000 per qualifying dependent child 17 or younger on Dec.

Help with childcare costs if. The child care tax credit was lower in previous years. Get the up-to-date data and facts from USAFacts a nonpartisan source.

If you had to pay someone to care for. How much you can get per child For the 2021 tax year the child tax credit offers. Claiming the Earned Income Tax Credit or the Child Tax Credit will slow down your tax return due to regulations designed to deter fraud but that means people who claim those.

No Tax Knowledge Needed. For tax year 2020 the maximum amount of care expenses youre allowed to claim is 3000 for one person or 6000 for two or more people. The advance is 50 of your child tax credit with the rest claimed on next years return.

In 2020 for instance the CDCTC was 20 percent to 35 percent of qualified childcare expenses.

3 Billion Tax Hike Over 5 Years Get The Facts

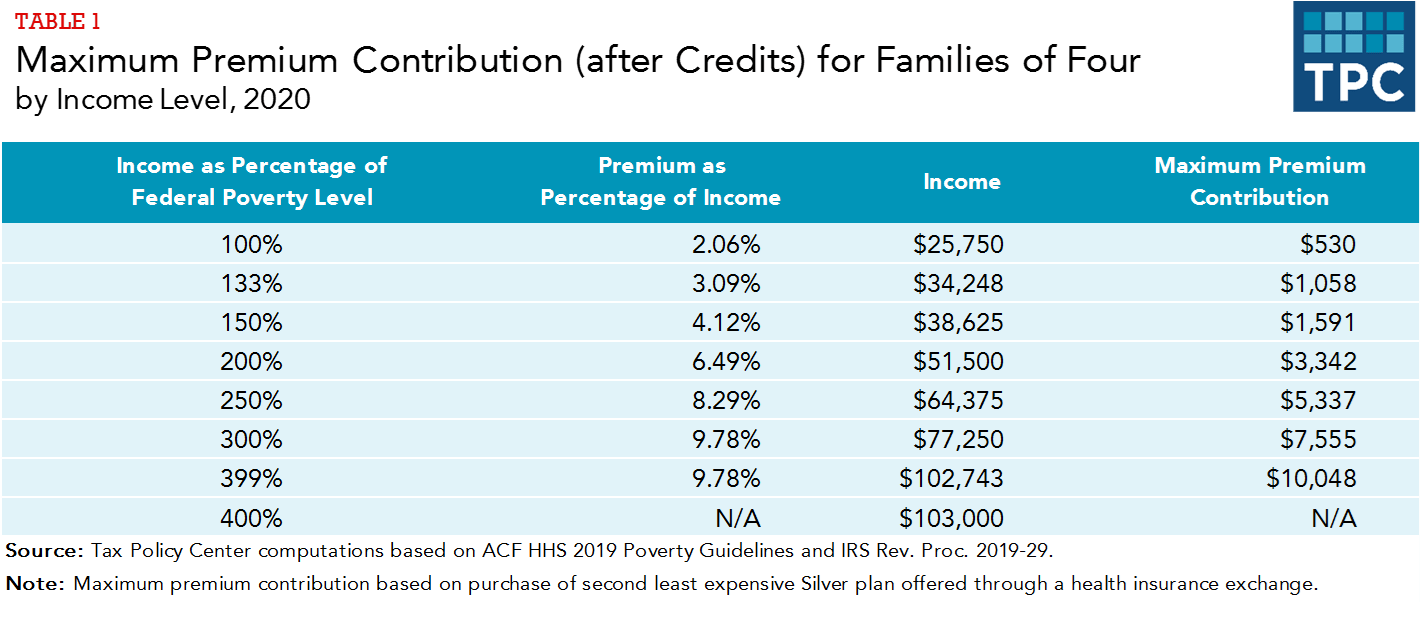

What Are Premium Tax Credits Tax Policy Center

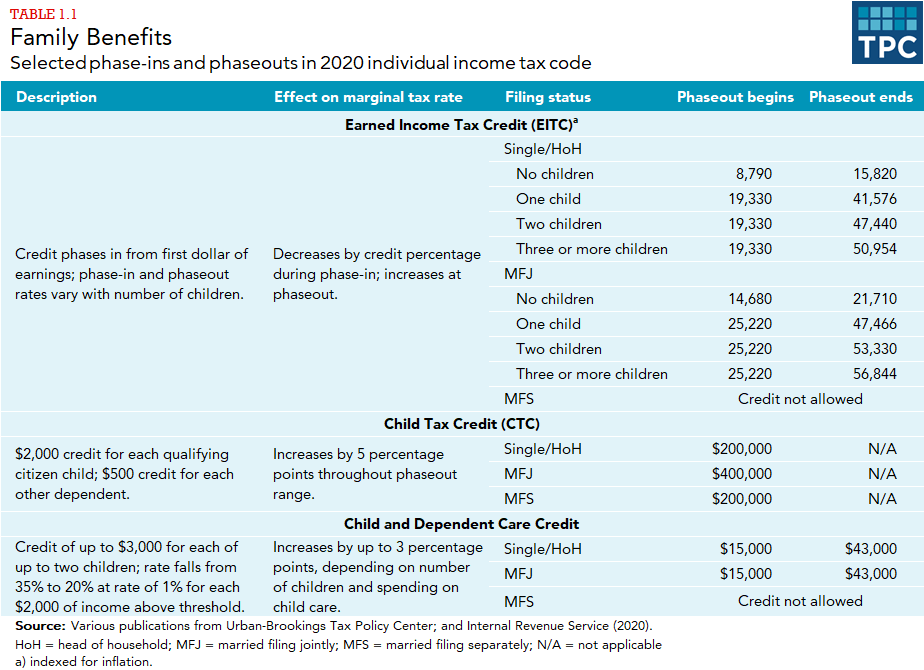

What Are Marriage Penalties And Bonuses Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Section 80dd Deduction For Expenses On Disabled Dependent Tax2win

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Child And Dependent Care Credit Definition

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Child And Dependent Care Credit Definition

Child Tax Credit Schedule 8812 H R Block

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post